Last month, Governor Tom Wolf signed Senate Bill 751 into law as Act 81 of 2017, which amends our commonwealth’s Mortgage Licensing Act.

These amendments provide a victory for our homeowners. For many years, the Department of Banking and Securities has been able to protect consumers in the way mortgages are marketed and sold, but not on the way they are managed after the homeowner has moved in. Pennsylvania now joins 36 other states that have taken on the responsibility to oversee non-bank mortgage servicers, which will be licensed and examined by our department.

Mortgage servicing is a critically important presence in a homeowner’s life. Often, even before the new homeowner settles in, he or she may be directed to make mortgage payments – and sometimes insurance, taxes, and other required fees -- to a company other than their lender: the mortgage servicer.

While the homeowner can choose their lender, the homeowner often has no choice in which company will service his or her mortgage.

We are less than a decade removed from the Great Recession and a foreclosure crisis here in Pennsylvania. Too often, we saw homeowners harmed by mortgage servicers outside Pennsylvania’s regulatory oversight, whose systems failed, resulting in payment errors and even wrongful foreclosures.

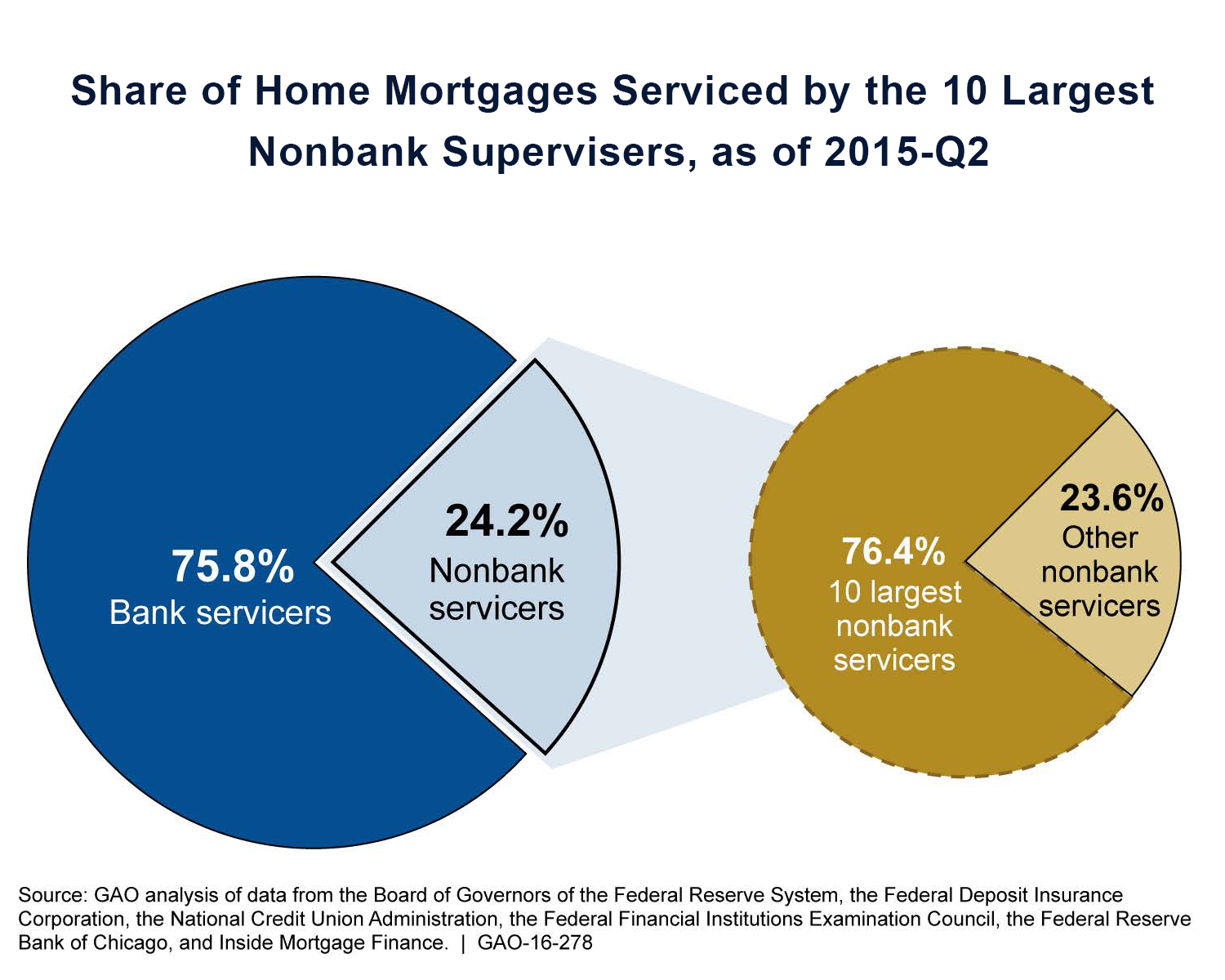

We are also witnessing an important new trend: the volume of mortgages serviced nationally by non-bank companies has grown significantly from seven percent of market share in 2012 to nearly 25 percent in 2015, and continues to increase.

While our commonwealth’s foreclosure crisis has passed, issues concerning mortgage servicing continue to be one of the top complaints received by the Department of Banking and Securities.

Amending the Mortgage Licensing Act will help protect homeowners from wrongful foreclosures by helping to ensure that companies follow Pennsylvania law, and the Department of Banking and Securities will have the authority to more effectively handle homeowner complaints about their mortgage servicers.

Moving forward, we will incorporate current federal standards for mortgage servicing that are already established in the marketplace, ensuring that companies doing business in Pennsylvania will work with a familiar and consistent set of rules and guidelines, as well as a streamlined process for licensing and compliance issues.

We anticipate accepting license applications for non-bank mortgage servicers on April 1, 2018, through Nationwide Multistate Licensing System (NMLS). The deadline for licensing applications is June 30, 2018.

Questions from companies about the license and the application process can be emailed to the department at mortgageservicing@pa.gov.

At the Department of Banking and Securities, we welcome questions and discussions, and we strive to be firm, fair, and consistent. Governor Wolf and I want the mortgage servicing industry to succeed in Pennsylvania. We believe in smart regulation, not regulation for the sake of regulation, and we will continue to vigorously enforce our laws to protect Pennsylvania residents.