As warmer weather arrives, the Open House signs dotting the landscape inspire many people to sell or purchase a home. Homeownership has always been a topic of fascination for American consumers. Owning your own home is a critical component of the American Dream and a tool to help families build wealth. As young people move to buy homes for the first time, keep in mind some of the issues and challenges you will face with this important transaction.

Challenges for Millennial Home Buyers

As recently as last year, it was reported that young adults (millennials) had no interest in homeownership and were more interested in experiences than putting down stakes with a 30-year mortgage (i.e., infamously, avocado toast). Also, many millennials were not purchasing homes at the same time in their lives as their parents or grandparents had, largely due to student loan debt.

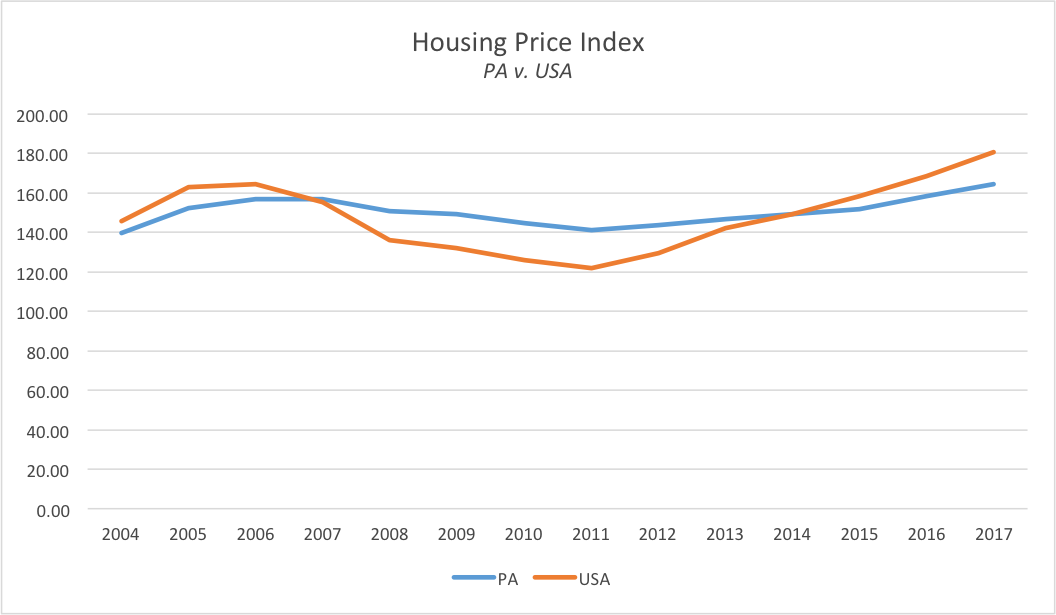

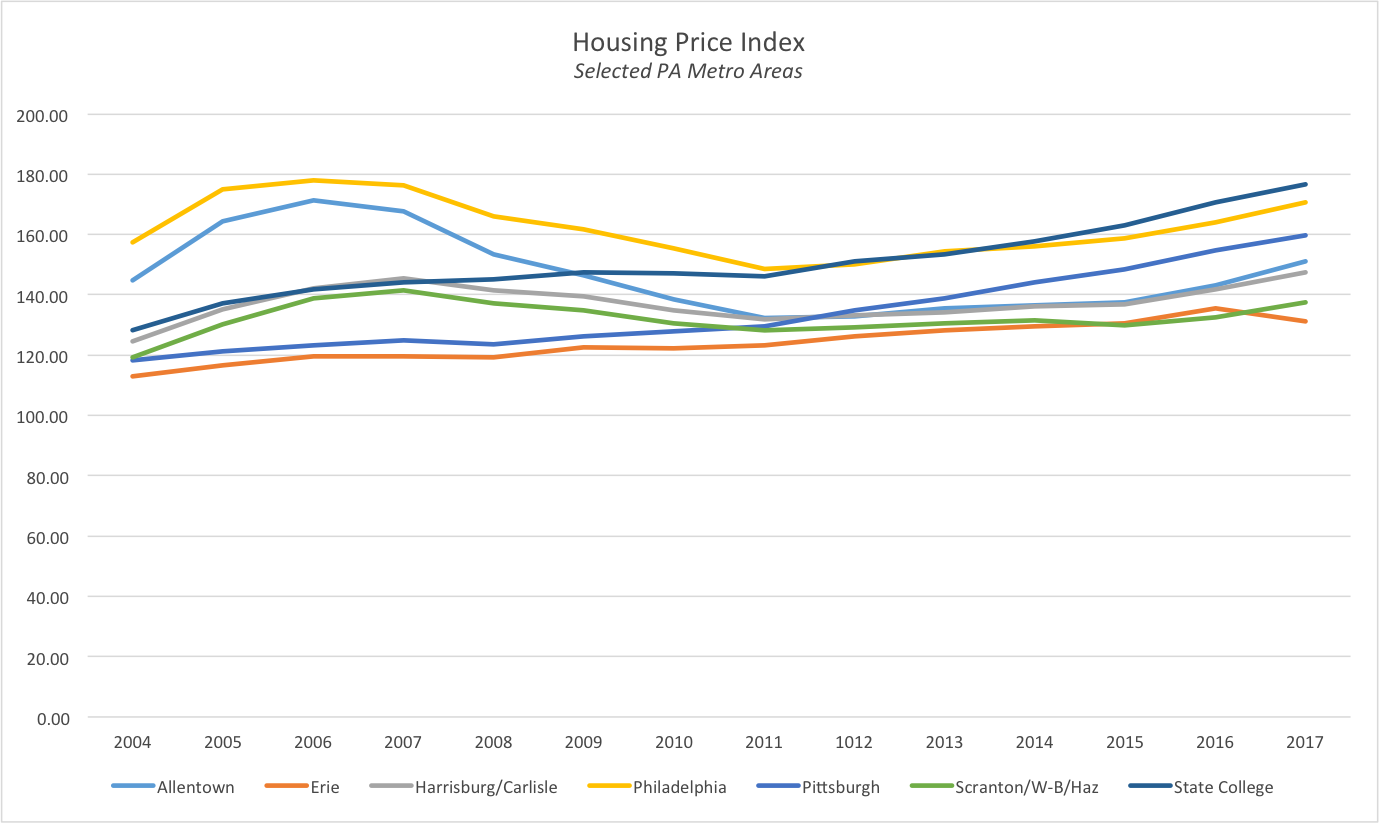

At the same time, millennials who have begun to enter the mortgage market are finding an aging housing stock that is having difficulty keeping pace with demand. This limited supply of housing stock is driving the cost of homes upwards. Data from Freddie Mac indicates the median house price for a home in Pennsylvania jumped 3.8 percent from December 2016 to December 2017. Put another way, a house sold in December 2016 at the median price of $158,690 put back on the market a year later would sell at around $164,330.

Source: Federal Home Loan Mortgage Corporation (Freddie Mac), Office of the Chief Economist

Overhousing, or Buying More House than You Need

In a culture where the concept of purchasing a home is often shaped like an episode on HGTV’s “House Hunters,” the reality of home buying is much more nuanced than a realtor showing three homes and the borrower(s) having to weigh pros and cons between commercials.

Purchasing a home at the top of your price range may provide the comfort of additional square footage and amenities but it also is likely to create unnecessary pressure on your budget. In addition to closing costs, appraisal costs, and various other fees and taxes associated with purchasing a home, homeowners must factor in ongoing costs with upkeep, utilities, maintenance, and furnishings. Home buyers should keep this in mind when considering a purchase and looking at a price range that is safely below their upper threshold.

Remember: just because a lender says you are qualified to borrow that much money does not mean you need to find a house that fits that price.

Interest Rates and Affordability

Last month the Federal Reserve Bank voted to raise the federal funds target rate by 0.25%. What this means is that borrowers will pay more for the loans they take from a bank or other mortgage lender.

Consider the following example of two home buyers purchasing identical homes but with a difference in their mortgage interest rate of .25%.

Borrower A

Loan: $200,000

Term: 30 years

Interest Rate: 4.45%

Monthly Payment (P&I)1: $1,007.44

Total Interest: $162,677.51

Borrower B

Loan: $200,000

Term: 30 years

Interest Rate: 4.7%

Monthly Payment (P&I): $1,037.28

Total Interest: $173,419.22

All things being equal, Borrower B will pay almost $11,000 more in interest over the life of the loan.

It’s important to check your credit score before purchasing a house. There may be actions you can take to improve your credit score to ensure you are getting the lowest rate possible. Compare rates from various lenders, and always make sure they are licensed by the Pennsylvania Department of Banking and Securities.

Next Steps

Purchasing or selling a home is a significant financial undertaking, but it does not have to be an overwhelming or complex experience. The Department of Banking and Securities has several publications to help you avoid any blind-spots when it comes to mortgages. For more, check out the resources below:

Buying a Home:

http://www.dobs.pa.gov/Documents/Publications/Brochures/BuyingAHome.pdf

Shopping for a Mortgage:

http://www.dobs.pa.gov/Documents/Publications/Brochures/ShoppingMortgage.pdf

____________________________________________

1The principal and interest payment does not include taxes, private mortgage insurance (if needed) or other items in escrow.