Robert* never planned on spending tens of thousands of dollars on drug addiction treatment for one of his children. As a successful Pennsylvania businessman, Robert had dutifully provided for his wife and two children, and put money away for retirement. Then he found himself faced with the prospect of borrowing against his 401(k) to finance his son’s third stay in treatment. Robert, now 67, has already worked well past his planned retirement date to make up for the retirement savings he spent instead on his son’s treatment.

Fortunately, Robert’s son is alive, though he still struggles with addiction. Unfortunately, this story is not unique during the opioid epidemic. The magnitude of this epidemic is startling in its reach and devastation. The problem has become so pervasive that earlier this year, in an unprecedented move, Governor Tom Wolf signed a statewide disaster declaration to enhance state response, increase access to treatment, and ultimately, to save lives.

Every day, at least 13 Pennsylvanians die of an opioid related overdose making it the biggest public health problem facing Pennsylvania. In 2016 alone, 4,642 Pennsylvanians died due to a drug overdose, an increase of 37 percent from 2015, making it the deadliest year in Pennsylvania history for overdose deaths. Pennsylvania was one of five states with the highest rates of death due to drug overdose.

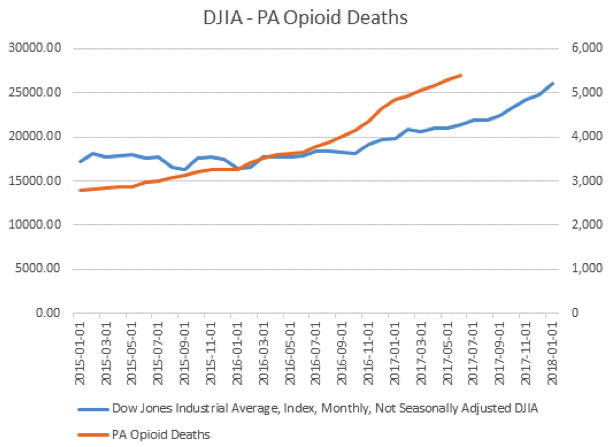

While 2016 was an historic year for the stock market breaking past 20,000, the year also saw the highest

number of Pennsylvanians die of an opioid related overdose.

Source: Federal Reserve Bank of St. Louis (FRED), National Center for Health Statistics

This crisis has a far-reaching impact, crossing socioeconomic lines, and investment advisers are beginning to see its impact on their clients and businesses. Last year, InvestmentNews surveyed 400 investment advisers and found that 36 percent have had clients who were struggling or had clients whose family members are struggling with an opioid addiction.

Financial devastation is becoming a looming risk as many clients are either facing addiction themselves or, like Robert, are desperate to save their children or grandchildren from the destruction of addiction. Today, with out-of-pocket treatment costing upwards of $50,000 and a high rate of relapse after treatment, many Pennsylvanians may be on the brink of financial disaster without guidance from the financial professionals in their lives.

Investment advisers are on the front lines of the opioid epidemic due to both the tremendous costs associated with addiction and treatment and their unique position to observe warning behaviors associated with financial exploitation. And yet the same InvestmentNews survey also revealed that more than 80 percent of investment advisers stated they did not have any training on handling opioid addiction.

Financial advisors can help clients prepare for future cash needs to help minimize financial losses. Additionally, clients and financial advisors should be aware of the risk of financial exploitation. Recognizing the signs of financial exploitation is a powerful measure to help protect clients when they are incredibly vulnerable. Some examples of common exploitation signs include:

Another line of defense against financial exploitation is ensuring that firms have sufficient internal controls. Addiction often takes over people’s lives, even the lives of people you may least expect. This disease affects all walks of life and backgrounds, and someone you know (e.g. a colleague, or an employee) could be struggling. Creating internal controls to identify questionable account activity and implementing strong verification protocols can help protect against financial exploitation by creating “red flags” to identify suspicious behavior. If there

is a sudden change in account control, or there is a lack of documentation? Are there unusual gains, losses, or distributions in an account? Creating checks to monitor this kind of behavior can be instrumental in identifying if financial exploitation is occurring, or if someone needs help.

In Pennsylvania, state and local government resources are available if you or someone you know needs help battling an addiction. Call a completely confidential hotline, 1.800.662.HELP (4357) for information about treatment resources. This hotline, staffed by trained professionals, is available 24 hours a day, seven days a week and is available in both English and Spanish.

The Department of Banking and Securities partnered with the PA Department of Health to provide a resource guide to assist financial professionals coping with the impact of the opioid epidemic.

The publication, “Opioid Epidemic: Its Impact on Investment Advisers, Their Clients, and Firms,” can be found online: www.dobs.pa.gov/Documents/Publications/Brochures/Opioid%20Guide.pdf

This guide suggests several steps investment advisers can take to help their clients as well as their own firms. We encourage you to look at the guide to learn more about practical application.

People suffering from opioid use disorder are our children, neighbors, friends, and colleagues. We should all be equipped to help them and families like those of Robert and Cheryl. Using available tools, investment advisers can play an important role in helping families address the financial challenges caused by the opioid epidemic.

__________________________________________________________

*Robert is a pseudonym for a real person whose story is true.