Crisis: an unstable or crucial time or state of affairs in which a decisive change is impending; especially: one with the distinct possibility of a highly undesirable outcome.1

p.p2 {

margin:0.0px 0.0px 0.0px 0.0px;

font:11.0px Arial;

min-height:12.0px;

}

p.p3 {

margin:0.0px 0.0px 8.0px 0.0px;

font:11.0px Arial;

}

p.p4 {

margin:0.0px 0.0px 0.0px 0.0px;

font:10.0px Calibri;

color:#0079cd;

}

p.p5 {

margin:0.0px 0.0px 0.0px 0.0px;

font:10.0px Calibri;

}

p.p6 {

margin:0.0px 0.0px 8.0px 0.0px;

font:11.0px Calibri;

}

span.s1 {

text-decoration:underline;

color:#0079cd;

}

span.s2 {

color:#000000;

}

span.s3 {

text-decoration:underline;

}

Pennsylvania families should be able to provide themselves with financial stability and create life-long financial independence. However, we are facing nothing less than a crisis when it comes to saving for retirement.

According to the National Institute on Retirement Security, nearly half of American working households have nothing saved for retirement.2

Let me repeat: nothing. No retirement account assets, whether in an employee-sponsored 401(k) type of plan or an Individual Retirement Account (IRA).

At the same time, Americans are under financial assault from many sources with: 80 percent of Americans have debt3, and more than $1 trillion in student loans are still outstanding4; an estimated $17 billion loss annually due to investments in conflicted financial products5; and an estimated $36 billion in losses each year suffered by senior citizens through financial abuse and exploitation.6

According to research from Boston College, at the rate of savings and available retirement assets, many Americans depend or will depend on Social Security to make up 70 to 80 percent of their pre-retirement income to maintain their lifestyle.7 It is not a stretch to state that there is a significant gap between what Social Security can provide and what many people expect for a comfortable retirement.

Clearly, too many Americans are putting off planning for life after they have stopped working full-time: many are going to rely too heavily on Social Security, and many will put off retirement and continue to work full- or part-time not by their choice well after normal retirement age. This is not the type of retirement they envisioned nor deserve.

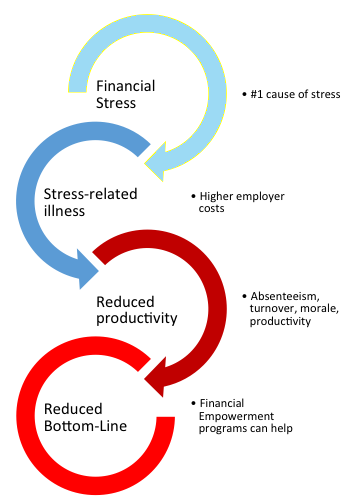

This situation is nothing less than a crisis for too many people, and one that goes beyond what’s in your financial accounts. Financial problems are the most common cause of stress in the United States. Stress is, or can be, an underlying cause of acute and chronic illnesses, which result in sick days and employees accessing employer-sponsored medical plan. Medical issues and stress-induced workplace distractions decrease productivity.

However, states are beginning taking proactive steps to meet this challenge head-on. In Pennsylvania, a bipartisan group of legislators and stakeholders launched www.myretirementpa.com to bring awareness to this issue.

However, states are beginning taking proactive steps to meet this challenge head-on. In Pennsylvania, a bipartisan group of legislators and stakeholders launched www.myretirementpa.com to bring awareness to this issue.

In the meantime, with the help of my colleagues at the PA Department of Banking and Securities, you can learn how to take control of achieving you own financial independence.

You can explore various approaches to financial independence by watching “When I’m 65,” a documentary (here) produced by a partnership of the Department of Banking and Securities, state securities regulators in other states, and the Investor Protection Trust. With the production of “When I’m 65,” we are helping provide information and tools so that our citizens can better plan how to fund their retirements.

You can take a class with the new STaRT (Start Today and Retire Tomorrow) program, which focuses on retirement planning, setting goals, and achieving those goals. We launched the STaRT this month with sessions in Berks, Lancaster, and Dauphin counties. Next month, STaRT will be offered in Lackawanna, Schuylkill, Bucks, and Lancaster counties.

You can also learn how to protect yourself and your assets from financial fraud and scam by attending a Scam Jam, Fraud Bingo, or “Avoiding Scams and ID Theft” program. We work with community and senior citizens’ groups, local, county, and state government agencies, and the Pennsylvania AARP Consumer Issues Task Force to present these programs. This month, these programs were offered in Montgomery and Lebanon counties; next month, they will be offered in Lawrence, Westmoreland, and Lancaster counties.

Learn more about the schedule for STaRT, Scam Jam, Fraud Bingo, and “Avoiding Scams and ID Theft" (here) or email informed@pa.gov to schedule a session for your group or conference.

It’s never too late to start – and the good news is that if you make the necessary changes today to meet your goals, you can achieve financial independence tomorrow.

______________________________________________________________________

1 https://www.merriam-webster.com/dictionary/crisis

2 The National Institute on Retirement Security: "The Retirement Savings Crisis: Is It Worse Than We Think?" www.nirsonline.org/reports/the-retirement-savings-crisis-is-it-worse-than-we-think

3 The Pew Charitable Trusts: “The Complex Story of American Debt” http://www.pewtrusts.org/~/media/assets/2015/07/reach-of-debt-report_artfinal.pdf

4 Center for Microeconomic Data, Federal Reserve Bank of New York “Student Loan Data and Demographics” https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/xls/sl_update_2016.xlsx

5 White House Council of Economic Advisers: “Middle Class Economics: Strengthening Retirement Security by Cracking Down on Backdoor Payments and Hidden Fees” https://obamawhitehouse.archives.gov/the-press-office/2015/02/23/fact-sheet-middle-class-economics-strengthening-retirement-security-crac

6 The True Link Report on Elder Financial Abuse http://documents.truelinkfinancial.com/True-Link-Report-On-Elder-Financial-Abuse-012815.pdf

7 Center for Retirement Research of Boston College: “How Much Should People Save?” http://crr.bc.edu/wp-content/uploads/2014/07/IB_14-111.pdf