Disclosure: the action of making new or secret information known.

Obfuscate: render obscure, unclear, unintelligible.

Misnomer: a wrong or inaccurate name or designation

We are all familiar with disclosures – the so-called “fine print” in contracts we sign or click to agree. But how many of us actually read the fine print?1

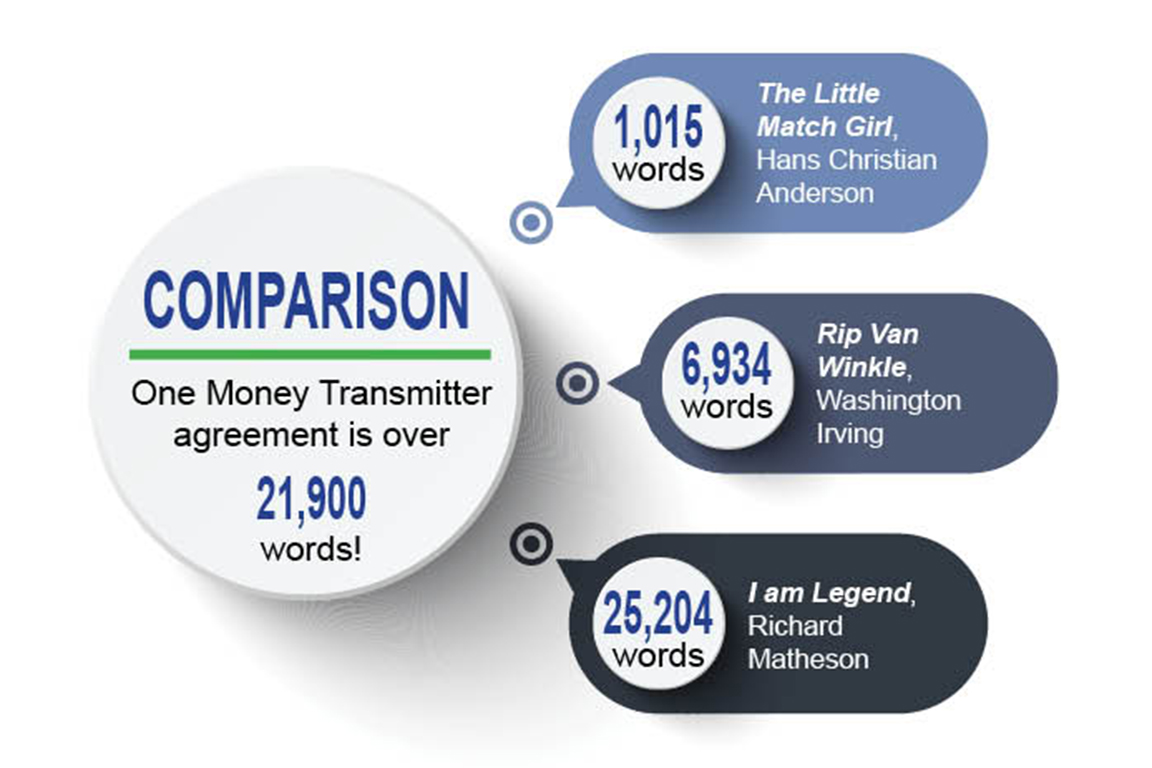

Disclosures should inform, but their length and complexity lead to the opposite effect, burying (“obfuscating”) valuable information in a verbal knot of legalese difficult to read and too lengthy to digest.

The consumer’s challenge with disclosures is compounded when the information is presented at the last minute, after the purchase decision has essentially already been made. Resigned to complete the transaction, consumers often agree to the terms of the disclosure, assuming they have certain rights and the ability to sue if things go wrong (a “misnomer” if there ever was one).

The consumer’s challenge with disclosures is compounded when the information is presented at the last minute, after the purchase decision has essentially already been made. Resigned to complete the transaction, consumers often agree to the terms of the disclosure, assuming they have certain rights and the ability to sue if things go wrong (a “misnomer” if there ever was one).

In fact, many types of contracts from digital licensing agreements to more traditional contracts require the consumer to waive the right to sue and agree to arbitration, decided by a third-party either employed by or paid for by the business.

As a result, the responsibility for providing a remedy when things go wrong has shifted from businesses to consumers. This practice is not new, and volumes have been written about this issue in the past 10 years by the government agencies, universities, and industry, primarily focusing on credit cards.

Consumer complaints received by the Department of Banking and Securities indicate consumer struggles finding remedies have remained persistent over the years. (You can learn more about financial challenges facing consumers by reading our second Annual Consumer Services Report).

Why do disclosures continue to persist in perplexing consumers? The answer is itself complex and multi-faceted.2

What can consumers do to protect themselves? You can choose to “vote with your wallet” by not purchasing a product or service that strips you of legal rights. You can also choose to read the disclosures BEFORE making a purchasing decision to ensure that you are not resigned to the outcome and are not surprised if something should go wrong.

Perhaps the most practical advice I can provide is to make sure you understand your finances and become well-Informed:

Or, if you have a complaint or question about financial services, products, or transactions, call our Consumer Services staff at 1.800.PA.BANKS. You can talk to a real, live trained professional.

From our 2015 Consumer Services Report

Disclosures to consumers have grown in length and complexity. Companies cannot disclose away, disclaim away, or have their customers contractually sign away certain lawful rights. Consumers feel that disclosures don’t help explain products, rather, they hide and confuse things. The length, complexity, form, and even font size can distract or discourage consumers from reading disclosures. Other times, consumers read the disclosures too late in the decision-making process to be effective, and no alternatives are offered.

____________________________________________________________

1For a thought-provoking historical analysis, I recommend reading “Unsafe at Any Rate,” Elizabeth Warren’s tour de force on consumer financial protection. The passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 affected some disclosures issues. More current analysis can be found in “How Much Mandatory Disclosure is Effective?” by Joshua Mitts.

2Jason Koebler describes End User License Agreements as “a Parallel Legal System” where you’ve voluntarily giving up “an absurd amount of power” https://motherboard.vice.com/en_us/article/wn949b/how corporations-use-end-user-license-agreements-to-create-a-parallel-legal-system